Reasons to Start Saving Money at Home and Its Benefits

Here is our approach to helping you save money around the house. It's crucial to save money, but it can be not easy to do so when trying to pay for everyday living costs. It is feasible to cut costs at home without having to give up the things you enjoy most with some creative budgeting and smart money-saving moves. The essay will discuss the advantages of home savings and why you should begin doing so. We'll also give you some real-world advice on cutting down on home costs that you can put to use right immediately. No matter how much or how little you've saved, this book will help you get your financial house in order and start saving money at home.

27 Ways to Save Money at Home Each Month

Create a Budget

To start saving money, making a budget is the first step you should take. It helps you keep tabs on your cash flow to see where you can make reductions. Prepare a budget by listing all of your regular monthly outlays: Write down your current monthly expenses and the total amount you spend every month. Remember one-time costs like meals and entertainment that you don't usually account for. Look for cost-cutting measures: Find ways to save money, such as using discounts, canceling unused subscriptions, or packing a lunch instead of buying lunch out.

Cut back on unnecessary expenses

To save money, you should eliminate any outgoings that aren't absolutely necessary. Several examples come to mind, such as paying for entertainment or food regularly. If you're trying to save money, you don't have to give up fun activities altogether. Instead, looking for less costly ways to do the activities you enjoy would be best. Cut back on the number of channels you get or look for other ways to view your favorite shows instead of canceling cable entirely. Finding a cheaper alternative or canceling the services you rarely use are better options than canceling all subscriptions. It's best to save eating out for exceptional occasions or as a treat rather than make it a daily habit. Finding a balance between minimizing costs and enjoying life is vital to successful home savings.

Use coupons and discount codes

If you do any shopping, whether online or in a store, you should always keep an eye out for coupons and promotional codes. This can help you save cash while shopping. If you want even more savings, join up for the email newsletters of your preferred stores and brands. Additionally, apps on the App Store and Google Play serve as a central repository for coupons and discounts for a wide variety of retailers and goods. You can discover coupons and discount codes for all sorts of things besides clothing and electronics, including food, household items, and even services like auto repair and beauty salon visits.

Shop around

Shop around first to find the best deal. You may now locate the most cost-effective option with this aid. Keep an eye out for deals or clearance prices during your shopping expedition. Merchandisers frequently mark down products that will soon be discontinued or upgraded. Always look for discounts like these, and use them if you find them. Another suggestion is to utilize a price comparison app or website to quickly and conveniently shop around and discover the best price. You should also explore second-hand purchases. If the item is in good shape, this might be a terrific method to save money. Used goods can be purchased at flea markets, thrift shops, and online auction houses. Before making a purchase, you should always check the item's condition to confirm that it works properly. With research and an open mind, you can cut your monthly spending without sacrificing your quality of life.

Use cashback apps

Get money back on your purchases using cashback applications. But, using a cashback app is an excellent method to cut costs without effort. When you purchase using one of these apps, you will receive a rebate on a specified percentage of your total. You can use the money you get back to pay for things or put it in your bank account. Rakuten, Ibotta, and Dosh are just a few examples of widely used cashback apps. The only thing you need to do to start using a cashback app is to download it and register for an account. After making a purchase, snap a photo of the receipt or link your payment method (credit card or debit card) to the app. Once you've made a purchase, the app will keep tabs on it and provide you with a rebate. Using the app's links to shop online can get you some more dough. You may receive a reward when you refer your friends or family to an app. A cashback app can help you save significant money over time. Before making a purchase, check the app to verify if the store you're at is affiliated with the app. In this method, you can get rebates on purchases you will make. One way to save money and get ahead financially is to use cashback programs.

Cook at home

Saving money on food is one of the many benefits of cooking at home. Plus, it's a far better option for your health than dining in restaurants. Home cooking can help you save money and eat healthier by allowing you to regulate what goes into your food and how much of it you eat. Costs can be reduced if you prepare meals at home rather than eating out. As a bonus, leftovers from a home-cooked meal can be used for lunch or dinner the next day, thus reducing the need to buy out. Additionally, compared to eating out, preparing meals at home might save money if you feed a large family or company. It's also an excellent way to explore culinary possibilities and gain kitchen experience. Rather than giving in to the temptation of ordering takeout or dining at a restaurant, try making a meal home. In the long run, it can help you save money and be good for your health.

Plan your meals

Create a list of what you need to buy and a menu plan for the week. Saving money on groceries and reducing wasteful impulsive purchases are also possible results. The best way to guarantee you have everything you need to prepare meals at home is to plan your meals in advance and create a grocery list. Not only may it help you stick to your spending plan, but it can also reduce your temptation to make unnecessary purchases. Meal preparation allows you to save money on shopping by finding recipes that call for items you already have on hand. Meal prepping also helps you buy what you need, reducing food waste. Saving money on food is simple: organizing your meals around specials and discounts. This can assist you in keeping from going overboard on your food costs.

Buy in bulk

When you use goods frequently, it might be cost-effective to buy in bulk. An excellent approach to saving money on things you use frequently is to purchase them in bulk, but you should only buy as much as you will consume before it spoils. You may be sure you're getting a good deal by comparing the cost of buying in bulk to the cost of purchasing a lesser quantity. Buying in bulk is a great way to save money and guarantee you'll always have the necessary supplies.

Use a shopping list

Before heading out to the store, take the time to compile a thorough shopping list. Saving money is as easy as avoiding those “just because” purchases. Keeping track of everything you need might be expensive, so a shopping list can help you find the best deals. By doing so, you may ensure that you are receiving the lowest price available on your purchases. You can control your spending, get the most out of your money, and obtain the best deals at the store if you use a shopping list.

- 10 Simple (But Not-So-Obvious) Ways to Make Money Online in 2023Are you sick of hearing the same old recommendations for making money online? Blogging, affiliate… Read more: 10 Simple (But Not-So-Obvious) Ways to Make Money Online in 2023

- How to make Money with YouTube in 2023Today we will briefly discuss how you can earn a passive income using YouTube in… Read more: How to make Money with YouTube in 2023

- How to Monetize YouTube and Get Rich Now?Here is a guide on how to make money and monetize YouTube: Video Format:ContentsHere is… Read more: How to Monetize YouTube and Get Rich Now?

- How to Make Money with Affiliate Marketing on YouTubeBecome Affiliate Marketer on YouTube and Get Rich Now!Contents1. Identify your target audience.2. Build a… Read more: How to Make Money with Affiliate Marketing on YouTube

- The Simpletons Guide to Niches That Will Make You MillionsWhat is a Niche? A niche market is a tiny, specialized market that refers to… Read more: The Simpletons Guide to Niches That Will Make You Millions

- 5 Steps to Affiliate Marketing using TikTok 2023I thought I'd give back by sharing with you guys a strategy I've been utilizing… Read more: 5 Steps to Affiliate Marketing using TikTok 2023

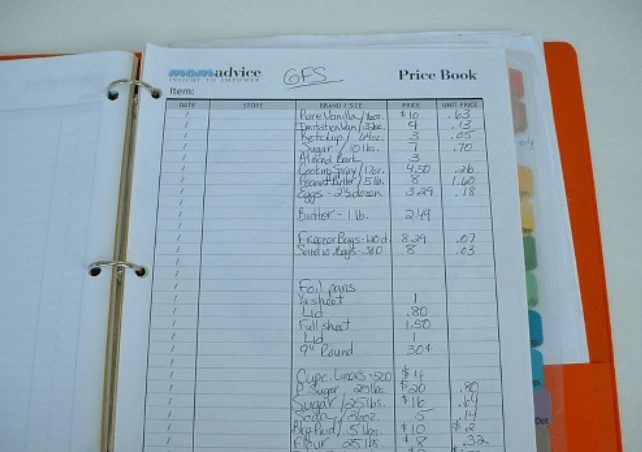

Use a price book

A pricing book is a great way to keep track of the costs of the things you buy frequently. Using this method, you can locate the most advantageous discounts. A pricing book is a valuable tool for keeping track of the costs of the things you buy frequently and locating the best offers. Making a price book is as easy as keeping a notepad, spreadsheet, or smartphone app with the current pricing of the items you buy frequently. You may find the finest discounts and keep track of pricing with the help of a price book. In addition to ensuring you obtain the most fantastic price, this might help you cut costs on your purchases.

Shop at discount stores

Get the things you need from dollar stores or bargain department stores. Shopping at discount or dollar stores is an excellent option to save money on necessities. It is possible to save money by shopping at these establishments because their prices are typically lower than those of standard retail outlets. Food, home items, apparel, and other items are just a few of the many that can be found at discount and dollar stores. Discount stores sell items that have been overstocked or are nearing their expiration date.

Avoid impulse buys

You should wait at least 24 hours before making large purchases to avoid buying impulsively. This will allow you to think about whether or not you really need to make the buy. One of the best ways to keep your cash in your wallet is to resist the urge to make an impulsive purchase. “impulse buying” refers to making a purchase without giving it much thought. Waiting twenty-four hours can help you control your spending habits and avoid buying on impulse. This will allow you to think about whether or not you really need to make the buy and whether or not it is affordable.

Use a rewards credit card

Spend on a credit card that offers you perks, like cash back or points. Finding the most fantastic rewards credit card for your spending habits can be done by comparing the perks offered by various cards. While some rewards credit cards provide cash back on all transactions, others provide points on select categories like gas and groceries. Finding a credit card with a sign-up bonus can help you save money on your first purchase. Credit cards with rewards programs allow cardholders to earn discounts and other benefits by making purchases with the card. Always pay your credit card debt month to prevent interest charges. Check out rewards credit cards to discover one that works for your spending habits.

Use a budgeting app

You can keep track of your spending with a budgeting tool and identify where you can make cuts. There is no better way to save cash around the house than by using a budgeting app. Keeping track of your spending with the help of a budgeting tool will help you identify where you can make reductions. To better manage your finances, keeping track of your spending is helpful. Syncing with your bank account and automatically generating a budget based on your earnings and expenditures are just two of the many capabilities of budgeting apps. You can better manage your money and get closer to your financial objectives by tracking your spending and saving habits in one place. It's a straightforward method, but it can help you save a lot of cash around the house.

Save loose change

Put your spare coins in a piggy bank or a jar. Over time, you'll have a nice sum of money that can be put toward more oversized items or saved. Putting aside spare change is a primary but efficient method of personal finance management. Put your spare change into a jar or a piggy bank whenever you find yourself with some. It's surprising how quickly spare change can stack up. Keeping your spare change in a piggy bank is easy to save money without even trying. It's a fantastic method to kick off your savings and get closer to your objectives.

Use energy-efficient appliances

Reduce your electricity bill by using appliances with better energy efficiency. Saving money at home is as easy as switching to energy-efficient appliances. These energy-efficient appliances might reduce your monthly electricity costs. Energy-efficient products utilize less power since that is how they were intended. Energy-efficient light bulbs, for instance, last up to 25 times longer and consume 75% less energy than standard incandescent bulbs. It's no secret that an energy-efficient refrigerator has a lower operating cost than a standard refrigerator because it consumes less power. Smart thermostats and plugs are two examples of high-tech household appliances that can help you reduce your energy bill and save more cash. With the help of these gadgets, you can monitor your energy use, make schedules for your appliances, and control them from afar. You can reduce your impact on the environment and monthly electric costs by purchasing energy-efficient appliances and smart home devices.

Unplug electronics

When not in use, unplug electronics to reduce your impact on the environment and your utility cost. One easy and effective method to reduce electricity consumption and costs is to turn off electronics when they are not in use. Television, computers, and chargers are just a few examples of the many electronic devices that use power even when they are not actively used. Known as “vampire energy,” this can cost money over time. It's a simple change that might save you a lot of money and energy at home.

Lower your thermostat

If you want to save money on your electricity bill, turn your thermostat up in the summer and down in the winter. You may reduce your heating costs by turning the thermostat up in the summer and down in the winter. Changing the temperature on your thermostat by just a few degrees can significantly impact your home's energy use and your monthly utility bills.

Plant trees

Shade from trees planted around a house can significantly reduce cooling costs. Planting trees around your property is an excellent strategy to reduce your monthly energy costs. Trees can help chill a house without using as much electricity by blocking some of the sun's rays. Trees not only provide needed shade but also help absorb and release heat, which can positively affect the temperature inside your home during the summer. They block the wind and help keep heat inside your house, which is very useful in the winter. Choose tree species that thrive in your area and will cast the most shade over your property when you grow them. Planting them on the east and west sides of your house, where the sun is most vital, is also essential. You can reduce your monthly energy costs by planting trees. Doing so is also beneficial for the environment and can make your home more aesthetically pleasing.

Seal your windows and doors

Keep the cold and warm air in by sealing the cracks around your windows and doors. The cost of heating and cooling a building can be reduced by sealing the windows and doors. Keep the heat in during the winter and the cool air during the summer by sealing off any draughts in your home. This can make your home more pleasant and reduce your energy costs. Use weather-stripping, caulk, or sealant to close any openings around your windows and doors. Look for draughts around the window and door frames, and fix or replace any damaged seals. A home with energy-efficient windows and doors can be more comfortable throughout the year. You may reduce your heating and cooling costs, make your home more comfortable, and help the environment by sealing the windows and doors.

Use a programmable thermostat

Please put in a programmable thermostat and set it to the ideal temperature for your home. You may reduce your heating and cooling costs by using a programmable thermostat. When you are not at home or asleep, you can set the thermostat to a cooler temperature, and when you are up and in the house, you can turn it up. As a result, you may see a decrease in your energy cost. It's also possible to make changes to some programmable thermostats from the convenience of your smartphone via an accompanying app.

Use LED light bulbs

If you want to save money on your electricity bill, go to LED bulbs. You can reduce your monthly electricity costs by using energy-efficient LED bulbs. In addition to lasting up to 25 times longer, LED bulbs consume far less energy than incandescent bulbs. As a result, you may reduce energy use and save money on maintenance costs. Additionally, LED bulbs are available in various color temperatures, allowing you to select the perfect bulb for any given situation. Replacing incandescent bulbs with LEDs is a simple and efficient way to cut your monthly electricity bill costs.

Use a power strip

Stop the power to several devices with one switch flip using a power strip. A power strip is a simple method for reducing electrical consumption and costs. A power strip allows you to connect to several devices without worrying about the energy they might need in standby mode. You may reduce the electricity required by appliances when they are not in use, lowering your monthly electricity bill. Power strips also aid in cord management and make it simpler to power down many gadgets simultaneously. A power strip is an easy and efficient way to lower your monthly electricity use and costs.

Use public transportation

Spend less on gas and repairs by taking the bus or train. Taking the bus or train instead of driving can help you save money on gas and car repairs. Take public transportation, such as buses, trains, or subways, instead of going yourself. Savings on oil changes, tire rotations, and brake repairs are in addition to gas cost savings. Taking the bus or train instead of driving also helps the environment and might save your commute time.

Carpool

Carpool to save money on gas and car maintenance.

Share rides and cut down on petrol and repairs. Sharing a ride to and from work with a colleague or friend can help you save money on petrol and repairs. You can also take turns behind the wheel can save money on gas and decrease the strain on your car's engine. Congestion in the transportation system can be alleviated, and your carbon impact can be minimized by carpooling.

Walk or bike

To avoid the high cost of gas and car upkeep, walking or riding a bike is preferable. Walking or riding a bike instead of driving can save a lot of money on gas and repairs. In addition to being the healthier and greener choice, it also helps you maintain an active lifestyle. Walking or riding a bike to work or other nearby destinations may be viable if you live in a somewhat compact area. You can save a significant amount of money over a year by making just one adjustment.

Consolidate errands

Reduce gas costs by grouping similar errands together. Run all your errands in one convenient trip. You may save time and money on petrol by doing this.

Final Thoughts

Finally, there are numerous opportunities to reduce monthly expenses within the confines of one's own residence.

To summarize:

You can save money by making a spending plan cutting back on unnecessary purchases, using coupons and discount codes, shopping around, using cashback apps, cooking at home, planning meals, buying in bulk, using a shopping list, shopping at discount stores, avoiding impulse buys, using a rewards credit card, using a budgeting app, saving spare change, using energy-efficient appliances, sealing windows and doors, using a programmable thermostat, using LED light bulbs, taking public transportation, and so on. Keep tabs on your development and make sure your efforts are consistent. The key to a brighter financial future is patience and determination.